brownman

Member

How the Expert Adviser Works

This Expert Advisor (EA) is built upon the foundational principles of W.D. Gann, integrating time-tested techniques with modern algorithmic precision. It analyzes the last two days’ candlestick statistics — including body, upper shadow, lower shadow, and price gap — on a specific timeframe to determine the market’s degree of movement. Leveraging 52 advanced mathematical formulas, the EA evaluates entry opportunities, drawing from Fibonacci-based market geometry. These formulas are carefully designed to detect market patterns, turning points, and trend continuation with a high level of accuracy.

This Expert Advisor (EA) is built upon the foundational principles of W.D. Gann, integrating time-tested techniques with modern algorithmic precision. It analyzes the last two days’ candlestick statistics — including body, upper shadow, lower shadow, and price gap — on a specific timeframe to determine the market’s degree of movement. Leveraging 52 advanced mathematical formulas, the EA evaluates entry opportunities, drawing from Fibonacci-based market geometry. These formulas are carefully designed to detect market patterns, turning points, and trend continuation with a high level of accuracy.

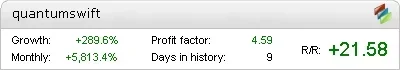

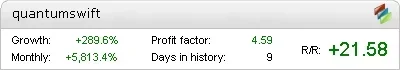

Quantum Swift

$3690- Easy Installation with video guidelines

- 1 User and a one-year license

- 24/5 Support

- Free Updates

features

- Adaptive Internal Functions: The EA adapts in real-time to changing market conditions without manual intervention.

- No News Sensitivity: Market news and fundamental spikes do not affect its logic, making it reliable during volatile sessions.

- Gann & Fibonacci Synergy: A unique blend of Gann’s degrees and Fibonacci ratios identifies high-probability trade zones.

- Real Market Performance: You can verify its efficiency through live account results — transparency and performance you can trust.

- Tight Stop-Loss on Every Trade: Each trade is protected with a tight stop-loss to limit potential losses and manage risk effectively.

- Automatic Position Sizing

Using stop-loss distance and account value, the EA determines the optimal lot size for each trade, ensuring the maximum loss does not exceed the set risk.